In the world of cryptocurrencies, understanding the factors that influence token prices is crucial for investors and developers alike. One such factor is the activity of unique users interacting with a token's smart contract. This article explores the potential relationship between unique user activity and token price effects, using data analysis and visualizations to uncover patterns and insights.

Case Study: Pendle Token

To illustrate this relationship, we examined the Pendle token over the past six months. The following graph (Figure 1) shows the 30-day rolling average of total transactions, 7-day rolling average of unique addresses, and the Pendle token price.

The graph clearly shows that spikes in unique user activity often precede increases in token price, supporting our hypothesis that user engagement drives price movements.

Correlation Analysis

Next, we analyzed the correlation between various metrics such as total transactions, total volume, unique addresses, rolling averages, and token prices. The correlation matrix (Figure 2) provides a clear picture of how these variables interact.

From the heatmap, we observe that the number of unique addresses and the rolling average of unique addresses have a strong positive correlation with the token price. This suggests that an increase in unique users interacting with the token is associated with a higher token price. This makes logical sense. This would mean there is a larger market participating in the token itself. A word of caution that this metric can be spoofed so its important to identify and remove certain spam activities. The analysis worked here but it might not always be the case. Also, Ethereum has a good embedded filter for this since costs are generally pretty high, but it may not be the case for other networks.

On to the Higher-Level Analysis

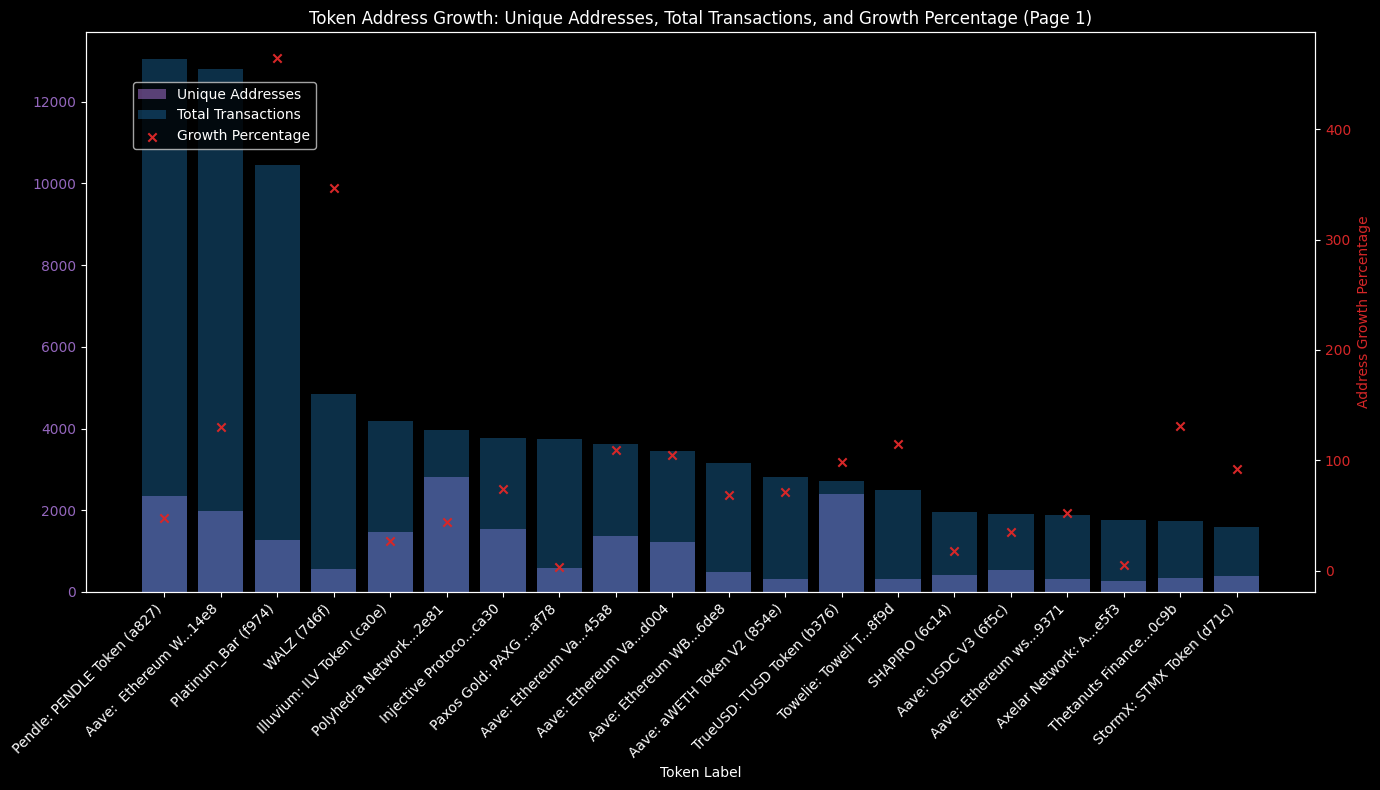

To look at this pattern on a larger scale, and really show off the power of onchain data, we searched the entire token space and found the unique address growth percentage across all tokens in the Ethereum network. This query takes about 5 seconds in Agnostic. The resulting bar chart (link to data below) illustrates the unique addresses, total transactions, and address growth percentage for a selection of top 20 tokens.

You can play with this chart live here

Tokens with significant growth in unique addresses tend to show corresponding increases in their transaction volume and often in their activity and price as well. Some interesting projects in this group are Walz (new VP pick for Kamala Harris), Injective, Aave, and Polyhedra to name a few. I personally think this is a great starting point for research into these projects to see what the growth is about. Its the projects that can continue to produce growth that might be attractive investments.

Conclusion

The analysis presented in this article suggests a strong relationship between the activity of unique users interacting with a token's smart contract and the token's price. As demonstrated through the Pendle token case study and the higher-level analysis of Ethereum tokens, increased user engagement can lead to significant price effects. At the very least it can be a springboard to launch further analysis. This insight can be valuable for investors looking to identify promising tokens and for developers aiming to boost user interaction with their projects.

By leveraging on-chain data and analyzing user activity, we can gain a deeper understanding of the dynamics driving token prices and make more informed decisions in the rapidly evolving cryptocurrency market.

You can access this query and get the data for yourself here at Agnostic

Please reach out for more information about the analysis. And signup to the newsletter to get more updates as they are shared.

Disclaimer

The information provided in this Substack is for informational and educational purposes only. It is not intended to be, nor should it be construed as, financial, investment, or legal advice. The content reflects the author's opinions and is based on personal research and analysis. Cryptocurrency investments are highly volatile and carry significant risks. Always do your own research and consult with a qualified financial advisor before making any investment decisions. The author assumes no responsibility for any losses or damages resulting from the use of this information.