The Changing Landscape of Bitcoin

Bitcoin has long been celebrated as a premier store of value, known for its scarcity and decentralized security. Yet, despite its status, it has largely remained yield-less, unlike Proof-of-Stake (PoS) chains like Ethereum and Solana, leaving much of its potential untapped. Historically, attempts to generate returns on BTC have often involved risky and centralized platforms like Celsius and FTX. These platforms promised yields that were often unsustainable or outright fraudulent, leading to significant losses for investors. As a result, many Bitcoin holders have grown wary of participating in yield-generating schemes, especially those with substantial counterparty risks, and have decided to HODL instead.

However, new innovations are redefining how Bitcoin can be used to generate yield safely and effectively. Babylon, for example, introduces a decentralized method that leverages BTC as a shared security asset to support Proof-of-Stake networks. By locking BTC directly on the Bitcoin network, Babylon allows holders to earn yield without the complexities of wrapping or the risks of centralized custody. This approach not only enhances network security but also opens up native yield opportunities for BTC holders.

Building on Babylon’s foundation, other solutions have emerged to further integrate Bitcoin into decentralized finance (DeFi) ecosystems. Products like LBTC, SolvBTC, and Coinbase BTC are expanding BTC’s utility, enabling it to participate in cross-chain DeFi activities and improve liquidity. Together, these innovations are transforming Bitcoin from a static store of value into an active asset that can secure networks, generate yield, and engage seamlessly across multiple blockchain ecosystems. In the sections that follow, we’ll explore the changes happening to BTC with these modern innovations and see the adoption through data.

New Developments in Bitcoin for DeFi: LBTC, SolvBTC, and Coinbase BTC

Recent innovations are bringing Bitcoin into the decentralized finance (DeFi) space with new products like LBTC, SolvBTC, and Coinbase BTC. These solutions allow BTC holders to use their assets more effectively across different blockchain networks, offering ways to generate yield, improve liquidity, and enhance network security.

LBTC and Bitcoin Staking with Babylon LBTC was developed by Lombard in partnership with Babylon to bring assets into Babylon’s network security market. By staking BTC through Lombard or swapping assets into LBTC, participants can take part in the yield generating opportunity. Babylon’s setup is similar to the Ethereum-based Eigenlayer, creating a two-sided market that allows BTC to be used in security protocols while remaining accessible for use across DeFi. LBTC is a receipt token that represents BTC staked in Babylon. This allows LBTC holders to earn yield while retaining flexibility to engage in DeFi activities like lending and collateralization.

SolvBTC and Cross-Chain Liquidity SolvBTC was created to address Bitcoin’s fragmented liquidity across different chains. Unlike traditional wrapped Bitcoin assets that are often tied to a single network, SolvBTC enables BTC to move freely across chains such as Ethereum, BNB Chain, and Avalanche. Through integration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP), SolvBTC facilitates efficient cross-chain transactions, allowing Bitcoin holders to access yield from multiple sources, including staking on PoS networks and delta-neutral trading strategies (Ethena). This approach provides flexibility for BTC holders to use their assets across various DeFi protocols without the constraints of high transaction costs and limited liquidity on a single chain.

Coinbase BTC: Bridging Off-Chain and On-Chain Coinbase’s cbBTC provides an on-chain version of Bitcoin backed by BTC held in Coinbase’s custody. This product allows users to transfer BTC from Coinbase onto Base and Ethereum, where it can be used in DeFi applications, and vice versa, without manual wrapping and unwrapping. Coinbase’s approach is designed to link traditional BTC liquidity with DeFi platforms, simplifying access for users who may prefer a more seamless connection between off-chain and on-chain Bitcoin assets.

A New Role for Bitcoin in DeFi Together, these products—LBTC, SolvBTC, and cbBTC—represent an expansion of Bitcoin’s utility beyond its traditional role as a store of value. By providing access to yield, improving liquidity across chains, and supporting network security, they allow BTC to play a more active role in the DeFi ecosystem. This marks a shift toward using Bitcoin as a shared security asset and a bridge between traditional and decentralized finance. So, how is adoption going?

Visualizing Bitcoin Derivatives Growth

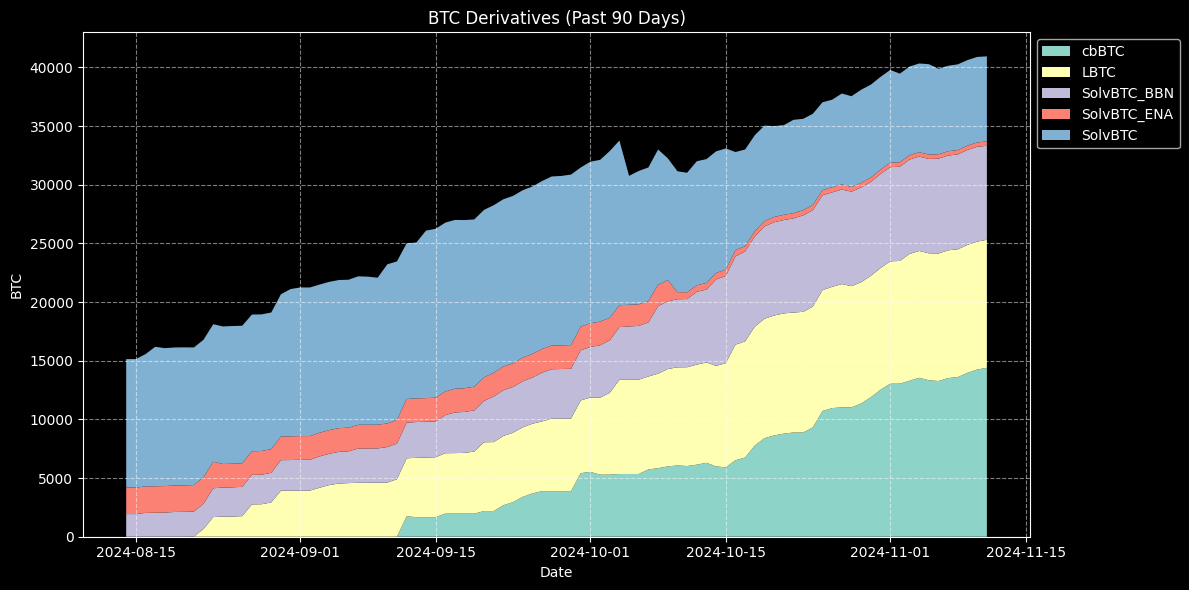

While Wrapped Bitcoin (WBTC) and similar products have long existed as bridges for BTC to participate in decentralized finance, these newer derivative products, such as LBTC, SolvBTC, and cbBTC, are gaining significant traction. The promise of yield generation without risk or the ability to stake Bitcoin as a security asset appears to have found strong product-market fit.

The stacked area chart below highlights the growth trajectory of these Bitcoin-backed derivatives over the past 90 days. The steady increase in total BTC value locked into these products illustrates the market’s appetite for yield-generating Bitcoin solutions.

This surge reflects a broader trend: Bitcoin holders are increasingly willing to put their assets to work, exploring secure and decentralized yield opportunities that have previously been more accessible to Ethereum holders. The availability of these new options provides BTC investors with more flexibility and the potential to generate returns in a manner similar to Ethereum’s staking rewards, further integrating Bitcoin into the DeFi ecosystem. Despite this growth shown, only $22.6 billion of Bitcoin’s $1.7 trillion market cap is currently utilized in these types of products (~1.3%). Why are these tokens popular?

Expanding Bitcoin’s Utility in DeFi

Bringing Bitcoin onto EVM-compatible chains opens up exciting possibilities for BTC holders to put their assets to work, earning yield while exploring additional strategies - even on top of staked yield (like that from Babylon). With these new derivatives, Bitcoin is no longer just a passive store of value but an active participant in decentralized finance. Here's how some of the most significant platforms are leveraging these tokens:

Aave Ethereum cbBTC (aEthcbBTC)

Aave, a well-established DeFi platform, provides a straightforward use case for cbBTC. By integrating cbBTC into its lending and borrowing markets, Aave has received over 8,500 cbBTC, allowing users to earn interest on their deposits or borrow against their Bitcoin holdings. This simple yet effective use of Bitcoin derivatives demonstrates how BTC can serve as collateral, leveraging the asset to amplyify yield.

uniBTC: Dual Yield Opportunities

uniBTC, developed by Bedrock, offers an innovative way for BTC holders, such as LBTC and SolvBTC users, to earn even more on their staking rewards. By minting uniBTC from their BTC, holders can accrue base yield through Babylon’s staking mechanisms and also obtain Eigenlayer benefits such as points and AVS rewards. Essentially double dipping in Bablyon and Eigenlayer, this approach makes it easy for BTC holders to generate returns from restaking all while benefiting from a liquid token that can again be used elsewhere.

etherfi eBTC: Multi Yield Opportunity

etherfi’s eBTC introduces a more complex but rewarding structure. Backed by LBTC and leveraging Babylon, eBTC allows users to earn yield from staking and additional restaking opportunities across platforms like Eigenlayer, Symbiotic, and Karak. This multi-yield model ensures that while the base yield from staking is being accrued, users can also capitalize on secondary strategies across various sources to maximize returns. On top of this is EtherFi’s own point system and yield for participation. For those looking to optimize their Bitcoin’s earning potential, eBTC offers a compelling, multi-layered solution.

Beyond the Basics: Pendle Yield Pools and Third Layer Strategies

Beyond secondary platforms, Bitcoin-based derivatives like eBTC can be further deployed into third-layer strategies, such as Pendle’s structured yield pools. These pools offer participants the opportunity to earn from swap fees and gain fixed yield exposure, with additional incentives layered on by various protocols.

Looking at the current landscape, we observe that the SY (Simple Yield) contract—designed to lock in a yield of 7% to 9% for eBTC—has retained roughly 40% of the token’s total supply. This is a notable decline from its earlier market share of approximately 50% in September 2024. The loss in market share seems to have shifted toward emerging opportunities such as Bitcorn and ZeroLend, reflecting the growing competition and dynamic nature of DeFi yield strategies.

For savvy BTC holders, leveraging these layered yield opportunities presents a chance to maximize returns—a strategy reminiscent of ETH restaking, which gained popularity less than a year ago. By tapping into these advanced financial mechanisms, Bitcoin is becoming an increasingly versatile and productive asset in the decentralized ecosystem.

Whales and External Sources Fueling On-Chain Liquidity

As the market for Bitcoin derivative tokens like cbBTC grows, it's critical to understand the origins of this influx. It's not merely a matter of recycling value across chains—converting from Ethereum-based assets to Bitcoin-based tokens would have limited impact. Instead, a substantial portion of the liquidity is coming from external sources, suggesting a more promising expansion of on-chain Bitcoin utilization.

A prime example of this is a whale address associated with Galaxy OTC, a major player in the crypto trading space. This whale has deposited nearly 10% of the total cbBTC supply directly from Galaxy OTC's reserves and also deposited those funds into Aave (becoming a participant in DeFi). Instances like this imply that the liquidity isn't just reshuffled from within existing DeFi ecosystems but instead represents fresh capital, potentially even native Bitcoin, being brought into decentralized platforms.

This influx of external liquidity could drive the growth and stability of these new BTC derivatives, signaling confidence from significant market participants and bolstering the adoption of Bitcoin-based DeFi applications. As whales continue to bring substantial value from exchanges onto the chains, the opportunities for leveraging these assets in yield-generating strategies become increasingly compelling.

Conclusion: BTCfi Unlocks Bitcoin's Untapped Potential

The emergence of BTCfi represents a transformative moment for Bitcoin, reshaping its role from a static store of value to a dynamic, yield-generating asset within the decentralized finance ecosystem. The introduction of platforms like Babylon, LBTC, SolvBTC, and cbBTC has unlocked opportunities previously reserved for Ethereum and other PoS networks, allowing Bitcoin to earn yield and participate in network security.

This shift isn't just about recycling value within the existing crypto ecosystem; it's about attracting fresh liquidity and tapping into Bitcoin’s full potential. Data highlights the substantial inflows from whale addresses are bringing new capital onto EVM-compatible chains. These developments suggest a growing confidence in decentralized yield-generating mechanisms, especially given their focus on reducing counterparty risk and enhancing the security of the Bitcoin network itself.

Moreover, third-layer strategies, like Pendle’s yield pools, exemplify how sophisticated yield optimization is now accessible to BTC holders. By building on top of base yields from platforms like Babylon, BTC investors can maximize returns in a multi-layered and strategic manner, similar to the ETH restaking playbook.

Overall, BTCfi is paving the way for Bitcoin to become a more versatile and integrated asset in DeFi. As we witness the ongoing adoption and growing competition among platforms, it’s clear that Bitcoin’s evolution in decentralized finance is only just beginning. This newfound utility has the potential to unlock trillions of dollars in capital and cement Bitcoin’s relevance not just as digital gold but as a productive, yield-bearing cornerstone of the crypto economy.

Get all the data used for this analysis live here: https://app.agnostic.dev/s/d/BUsLour5cbq